What Is Bitcoin and How Does It Work? Cryptocurrencies, or digital money, allow users to transact similarly to traditional currencies. Bitcoin is one of the most prominent and pioneering examples of this type of money. Bitcoin debuted in 2009, but it wasn’t until about 2017 that it became a well-known brand. When the price of one Bitcoin jumped threefold in weeks to about $20,000, it became a global news story. While most people lost interest in Bitcoin when its price dropped below $3,500 in a year, the cryptocurrency made a triumphant return, and the blockchain technology that underpins it is still in use today.

How Does Bitcoin Work?

Bitcoin is a digital currency that is decentralized and entirely electronic. Governments do not mint or support Bitcoins, unlike fiat currencies like the US dollar, Euro, or British pound. The underlying “blockchain” technology powers Bitcoin and many other cryptocurrencies. Though it may sound like technobabble, the idea behind the Bitcoin blockchain—a decentralized public ledger—is relatively simple. A decentralized ledger (or database) is neither established nor maintained by a single entity or central bank; in the case of Bitcoin, this would be a vast network of computers. New information, such as recent transactions, is grouped to form a block. The block is then added (or chained) to the existing database. Once new information is added, it can’t be edited or deleted, and anyone can review the BTC blockchain database. The result is a permanent record of Bitcoin transactions available for public review.

For example, if you send Bitcoins to someone else, an uneditable transaction record is added to the ledger, synced on tens of thousands of computers worldwide.

Bitcoin permits some anonymous transactions. The transaction from person A to person B is public, but A and B are unknown. Publishing your BTC address (the address you use to receive payment) breaks anonymity. Your Bitcoin address lets others see your transactions and balance. Bitcoin miners provide computer power for these problematic maths. Miners receive Bitcoins to process transactions on their computers. Anyone can mine Bitcoin, but electricity costs may exceed earnings.

Should I Buy Bitcoin?

Not only can you earn BTC via mining, but you can also buy and trade it online. But think about the risk and your reasons for wanting to acquire it before you do that.

Some businesses accept Bitcoin, so it’s not simply for transmitting money. Due to its volatility, Bitcoin isn’t good for regular purchases. After all, it would be a pity to buy a new computer with $1,000 of BTC and discover that it’s worth $3,000 a few weeks later. Alternatives include cryptocurrencies like gold as safe havens for wealth. Even though gold isn’t a conventional payment method, you may want to buy it if you think its value will rise. For some, Bitcoin is a rewarding investment. Selling BTC for less than they purchased them has cost some a lot, but that’s investing. When a Bitcoin site was hacked, several investors lost all their money and couldn’t find the offenders. Consider the considerable risk before buying.

How to Buy Bitcoin

Using an online exchange is the most convenient way to buy Bitcoin. Binance, Coinbase, Gemini, and Kraken are among the most well-known choices.

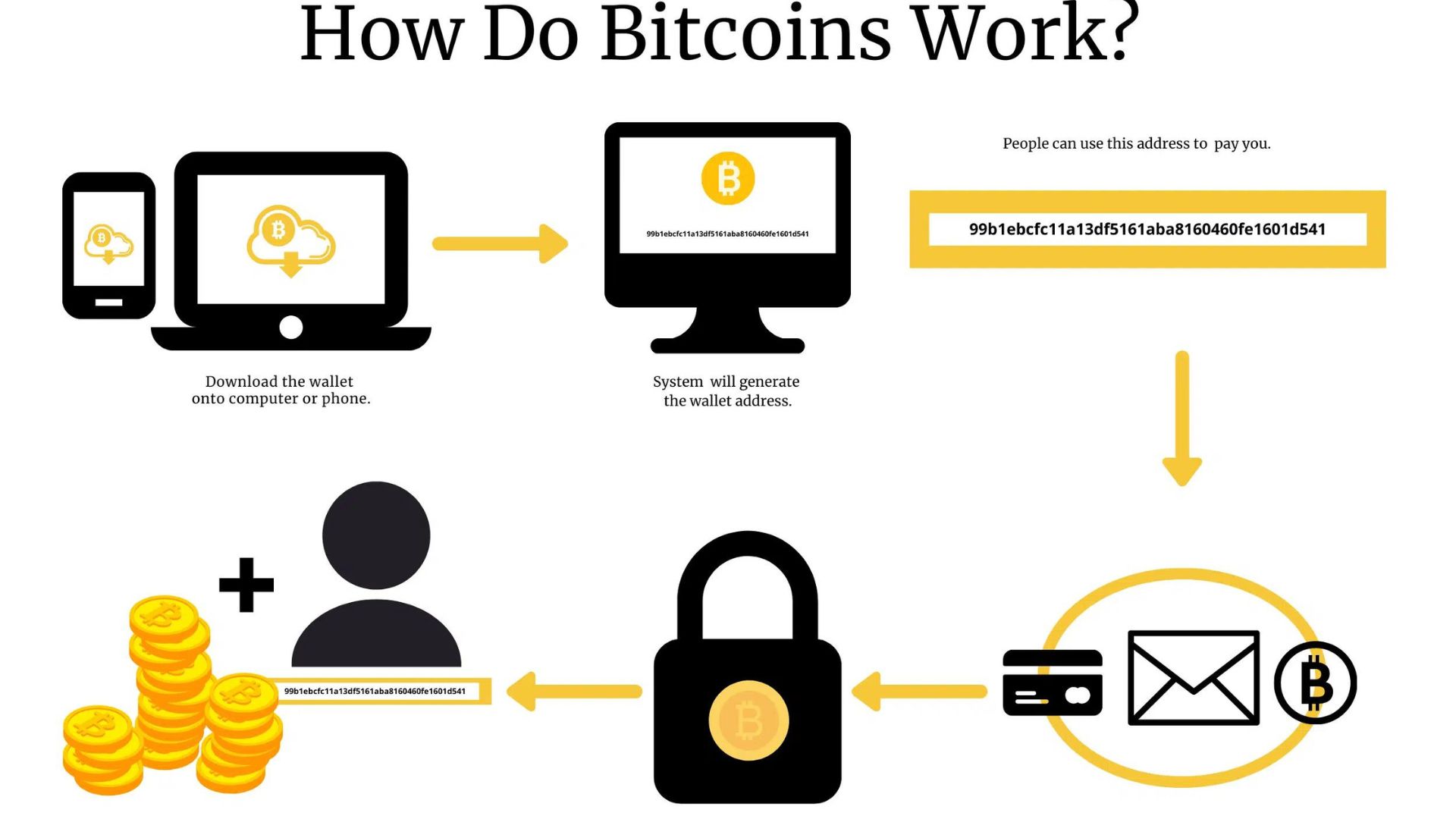

On these marketplaces, you may purchase Bitcoin with various payment options, including bank accounts, credit cards, and cryptocurrency exchanges. The price of Bitcoin might change marginally across platforms, and transaction fees are likely to constitute an additional expense. When purchasing BTC, a digital wallet is also required. Rather than being physically kept in your wallet, Bitcoins are a part of the public blockchain. But the public and private keys are stored in your digital wallet. Anyone you share the public key with can send you Bitcoin. Never give out your private key to anyone; it’s the only way to send BTC. You might think of it as the password to your internet banking account. If you share your bank account information with others, they can send you money, but no one else can access it.

You may buy, sell, and transfer BTC on several public platforms. You can even build a digital wallet on the platform. Using a platform to manage your cryptocurrency accounts is typically more accessible than other online accounts because of the platform’s user-friendly design. Storing your private key in a secret location, like a flash drive or written down on paper, is the safest way to keep Bitcoin.

What Is the Future of Bitcoin?

Blockchain technology, which supports the Bitcoin network, is versatile and might be used by other companies. The future may also see a rise in the general popularity of cryptocurrencies. It is, however, hard to predict whether BTC will continue to be the most widely used cryptocurrency or whether another platform will overtake it.

Alternatives Ways to Invest

If you’re nervous about taking too much risk, you should probably start small and invest only a tiny percentage of your portfolio in BTC and other cryptocurrencies. Consider adding other investments to your portfolio to increase its diversification, such as:

- Stocks: A share of ownership in a corporation is what you get when you invest in its stock. As the company’s worth rises, so too may the stock’s value; some businesses even pay out dividends to their shareholders. You risk losing everything if a firm you’re investing in declares bankruptcy, which is why stocks aren’t for everyone.

- Bonds: Corporate and government bonds are like loans to businesses and government agencies; you can buy them with money. Lenders can collect interest on their money and get their principal back when the loan term ends.

- Mutual funds and exchange-traded funds (ETFs): Mutual funds and exchange-traded funds (ETFs) allow investors to pool their money and put it to work in various markets at once. A basket of equities and bonds or an index tracking the performance of a basket of stocks and bonds can make up these funds.

Even if you’ve never invested before, several simple methods exist to get your feet wet. Opening a brokerage account, funding it with a bank transfer, and buying investments can be done online or using a mobile app. On the other hand, a 401(k) or different employer-sponsored retirement plan or an individual retirement account could offer you tax benefits when you invest for retirement.

Will Buying Bitcoin Impact Your Credit?

Your credit history and scores are unaffected by your money in checking, savings, or investment accounts. Your credit is not affected by your income or net worth. Consequently, buying BTC will not have any impact on your credit score. But if you pile up BTC hoping to make a fast buck and its value falls, you can end up in a jam, and your credit could take a hit. Additionally, you risk getting into credit problems if buying Bitcoin makes you rack up a large credit card bill, which raises your credit utilisation and leads to missed payments if you cannot pay it off.