Digital Asset Products Notch Third Consecutive Weekly Inflow, Attract Over $15 Million. Digital assets have established themselves as a significant player in the dynamic and ever-shifting environment of the global financial system. Those days, in which they were just speculative vehicles for specific types of investors, are long gone. They are currently the focus of attention among ordinary investors as well as institutional investors. The recent increase in the amount of money flowing into items. Related to digital assets is evidence of the growing significance of these assets. These goods have attracted over $15 million in investments over the past week. This marks the third week in a row that they have seen a large flood of capital.

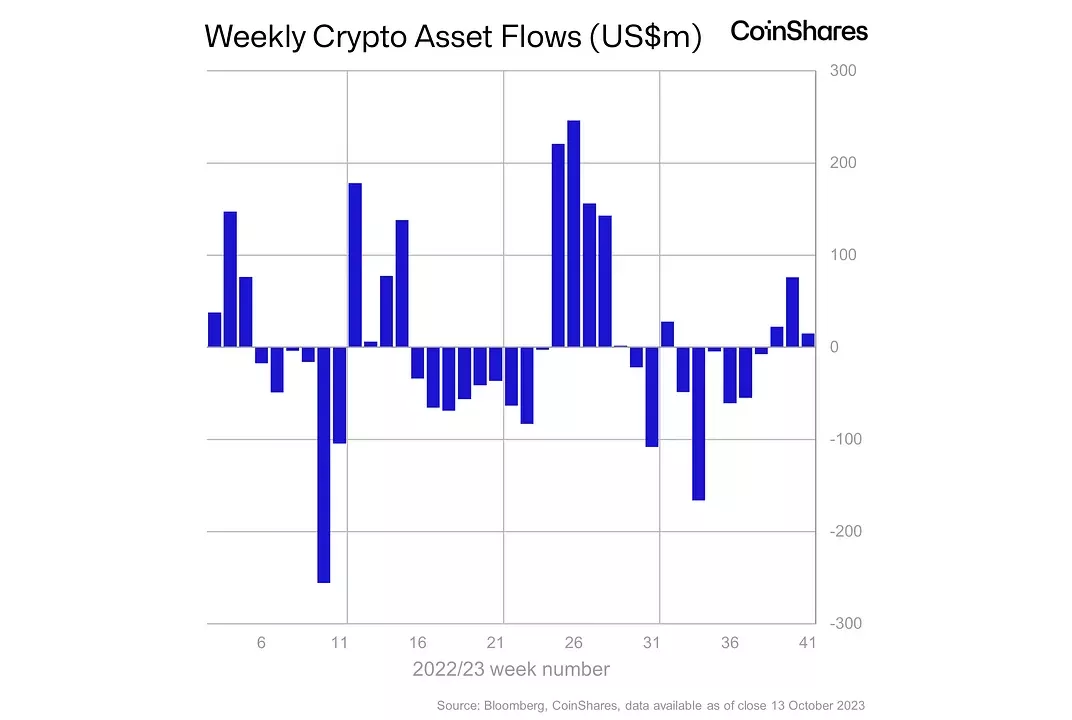

After a rocky beginning to the year. Institutional investors have shown signs of improved attitude by increasing. Their purchases of cryptocurrency goods for the third week in a row. showing that the market has turned a corner. Although trading volumes were 27% lower than the yearly average. The research states that digital asset products. Nonetheless managed to rake in a total of $15 million in new funds. Bitcoin (BTC) has continued to be the leading gainer. Accumulating a total of $16 million in new funds over the past week. While short bitcoin has seen a total of $1.7 million in new funds.

As the market turned green, indicating optimistic indicators, the prior report revealed that Bitcoin had received inflows totaling $43 million. The total entry surrounding the market leader has climbed to $260 million. Fueling bullish interest despite the reduction in weekly volumes. As a result of the Securities and Exchange Commission’s (SEC) decision not to appeal the Grayscale ruling. This may lead to a potential approval in the coming months. Specialists recommend further consolidation of recent wins from institutional clients.

This comes on the heels of the SEC’s decision not to appeal the ruling. “It is important to note that our data. Was not likely to capture the positive news coming out of the United States. The SEC’s decision not to appeal the Grayscale legal challenge.

Altcoins can’t keep up with momentum

It was a terrible week compared to past norms as more activity was witnessed around Bitcoin. Even though certain alternative cryptocurrencies saw minor gains, it was a poor week overall. After posting gains in the wake of the debut of futures-based exchange-traded funds (ETFs). Ethereum (ETH) suffered withdrawals of $7.5 million during the previous week. According to analysts working for CoinShares. The recent drop in value may be the result of concerns about a modification in the protocol’s design. After experiencing many weeks of outflows, Ethereum was able to garner inflows totaling $10 million. These inflows were contrasted to the first week that futures-based Bitcoin ETFs were published. A figure that was described as small in comparison to the leader of the market.

Solana (SOL) notched its highest week since March in the previous week but reported a small figure last week as the harsh winter marched on. This was even though Solana had previously notched its highest week since March. Ripple (XRP) reported a modest influx of $0.42 million, but this was sufficient to extend its streak of 25 consecutive weeks of positive inflows, which came as a result of increased community engagement and strategic partnerships. According to the research, “The consistent inflows underscore the investment community’s support,” which is particularly relevant when taking into account the victorious legal challenges brought against the SEC. Outflows of capital totaling $0.28 million, $0.31 million, and $0.25 million were recorded for Litecoin, Chainlink, and Tezos, respectively.

Geographic disparities continue

The regional split that exists between investments in Europe and the United States of America remains, with Europe registering investments from institutional products. During the past week, there was a general decline in data, which brought Europe’s total down to $7 million. Despite this, Europe is still in front of the United States, which is struggling with regulatory concerns and an “overreaching” SEC.

Germany remained in first place with net inflows of $16 million, while Switzerland maintained its position as the runner-up with net inflows of $500,000. Sweden was the only country in Europe to experience a net outflow of money, which totaled $7 million.

Disentangling the Varied Forms Taken by Digital Asset Products

Before delving into the nuances of this investment fad. It is essential to get a firm grasp on the scope of what is meant by the term “digital asset products. Cryptocurrency funds are investment vehicles that enable investors to obtain exposure. A variety of cryptocurrencies without the necessity of actually holding the digital assets themselves. They might follow the price of a single cryptocurrency. Such as Bitcoin or Ethereum, or they might provide. A diversified portfolio of many coins. Tokenized Assets are real-world assets. Such as real estate or art, that have been “tokenized. Or represented by digital tokens on a blockchain.

These assets can be traded just like any other digital token. DeFi Products, which stands for “Decentralized Finance,” are financial instruments or platforms built on blockchain technology that aim to duplicate traditional financial services, such as lending or borrowing, without the need for middlemen. NFT Funds are investment pools that concentrate on Non-Fungible Tokens, which are one-of-a-kind digital tokens that represent ownership or proof of authenticity of a certain item or piece of material. NFTs can be used in a variety of applications, including gaming, finance, and content distribution.

Factors That Are Responsible For The Increase In Investments

The increasing attractiveness of digital asset solutions can be attributed to several factors, including the following: Mainstream Acceptance As major financial institutions, corporations, and significant personalities continue to declare their support for digital assets or invest in them, the legitimacy of these assets continues to increase in the eyes of the general public and traditional investors.

Strong Returns:

Despite the unpredictability of the market, several digital assets have generated remarkable returns, which has attracted the attention of investors searching for profitable alternatives.

The Importance of Receiving Funds on Three Different Weeks in a Row

It is impossible to overstate the importance of consistent investment inflows, particularly in an asset class that has a history of being as volatile as digital assets:

Investor Confidence

Three weeks of uninterrupted inflows suggest persistent confidence among investors, indicating a wider acceptance and comprehension of the value proposition presented by the asset class.

Maturity of the Market

Regular inflows might be an indicator of a mature market since they reflect the presence of investing that is more knowledgeable and strategic than simple speculative activity.

Assembling the Foundation Consistent investment supplies the liquidity and cash necessary for the growth and development of the digital asset ecosystem, which is required for these endeavors.

Obstacles and Things to Take Into Consideration for Investors

Although the momentum is undeniably in the right direction, it is vital to keep in mind that the field of digital assets is not devoid of difficulties: Uncertainty Regarding Regulation: The worldwide regulatory framework for digital assets is still quite fragmented and is constantly changing. There is the potential for regulatory crackdowns or policy shifts to have a big effect on the market.

Volatility in the Market Digital assets is notorious for the price volatility they exhibit. Which may result in big financial gains for investors but also substantial financial losses. Risks to Operations Because of the digital nature of these assets. That there could be technological flaws. Or that there could be problems with asset custody.

Concluding Remarks on the Changing Characteristics of the Digital Investment Landscape

The line between traditional banking and digital finance is becoming increasingly blurry, which means that the opportunities and problems posed by this developing business are becoming increasingly significant. The market for investments is being increasingly dominated by digital asset solutions, which have already attracted more than $15 million in just three short weeks. Nevertheless, a cautious and well-informed strategy is vital, just as it is with any investment. It will be intriguing to see the trajectory of the market as it continues to evolve, as well as the ripple effects it causes across the wider financial environment.